Making the world a smarter place

Digital Assets as a Service

Who we are

We help financial institutions and businesses to monitor and invest in real-world assets by providing enterprise-grade technology for asset digitalization.

Together with our clients and partners, we are taking the lead in making the world smarter, sustainable and more innovative. We aim to capture a significant part of the fast growing market for Digital Assets through our as-a-service solution enterprise-grade DLT technology.

We offer investors the opportunity to join us on our mission.

We have an outstanding team of 14 (2 full-time co-founders, 10 full-time employees) and 5 advisors. Combined our team has several decades of managerial, commercial, asset management, cyber security and decentralized technology expertise. Learn more below and book a meeting to find out more.

We have a quality pipeline of customers with a value of 10M USD Annual Recurring Revenue.

A new era of possibilities

The next generation of the internet will be built on digital asset infrastructure. Financial and ESG regulatory frameworks and stronger reporting standards is driving the market growth. Financial institutions and large corporates are racing to capture a piece of the $16 trillion USD global market.

While, players like J.P. Morgan, UBS, Citi, Blackrock Asset managers and other financial and investment powerhouses are focusing on traditional assets, such as, securities, bonds and other financial instruments, we focus is on complex and alternative assets, like real estate, commodities, non-listed shares, underutilized infrastructure and endless other possibilities.

Our unique Neuro Services Technology positions us to capture a significant part of the $16 trillion USD (TAM) digital assets market.

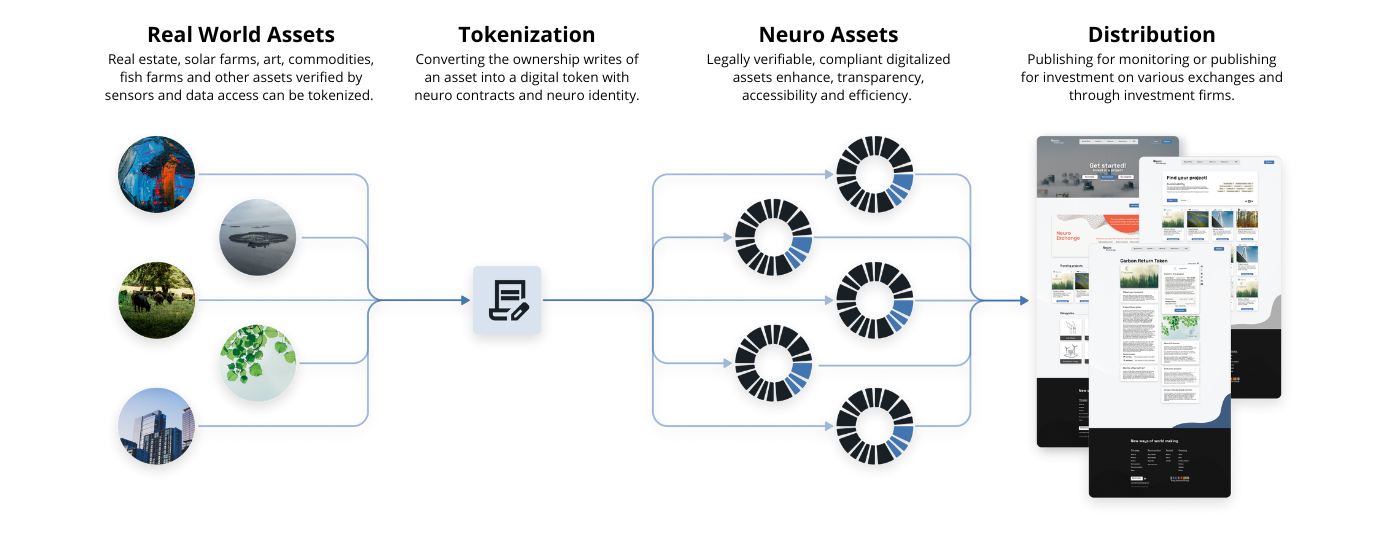

How it works

.png?width=800&height=800&name=Untitled%20design%20(3).png)

Our tech at work

Client use-case:

Carbon offset certificates verified and tokenized by Neuro, Digital Asset-as-a-Service.

Traditional carbon offset market methods lack transparency and traceability and therefore facilitate double counting when claiming carbon credits. The market is also largely inaccessible.

We created a solution for digitalized measuring, reporting, and verification system of the carbon offset process allowing, for the harmonization with national and global registries needed to accurately report progress to the Paris Agreement, avoiding double counting and double claiming. The process is transparent and can be verified by a third party. By digitalizing carbon credits we have increased access and availability to the carbon offset market.

We have many more examples of how our technology transforms our customers businesses. Book a meeting to learn more.

Selection of partners

Our uniqueness

Competitive Advantage

Our key competitive advantage versus competitors and peers like Corda, Cardano and Ethereum is focused around Compliance and Enterprise readiness. With legally verifiable smart contracts, cryptographically secure identities for all, and programmable money that empowers peer-to-peer payments, online and for our patented off-line payments we stand out as the most enterprise ready DLT of all.

Fast and sustainable

No need for Proof of Work or Proof of Stake. Federated blocks provides extreme speed with significantly lower energy use.

Compliant

Our enterprise grade solution is auditable and supports regulatory compliance and legal frameworks.

Secure and private

Military grade dynamic encryption along with stronger information privacy, is made possible since transaction information is only available on permissions.

Investment opportunity

With over 10% monthly growth and more than 50 customers such as Atlantic Bank, BIG Travel, Creturner carbon credits, DeTrash recycling, Vaulter mobile escrow, and Wawcash micro-credits, as well as an extensive partner network including IBM, Microsoft, Serpro, VISA/MC, Stripe and Worldline; Neuro by Trust Anchor Group is now seeking funds to continue to grow faster and further.

The investment is needed to:

- Scale business internationally, specifically in the European, US and LATAM market

- Reach 200+ more customers and $3M net new revenues worldwide by Q4 2025

- Strengthen the team with new hires in sales and marketing, as well as new hires in IT product development and operations.

- Secure IP and Patens pending as well as Compliance roadmap